Postal life insurance has recently launched the NACH facility through SBI for the collection of PLI/RPLI renewal premiums through PLI Standing Instruction (SI) automatically from any bank account of the existing PLI customer.

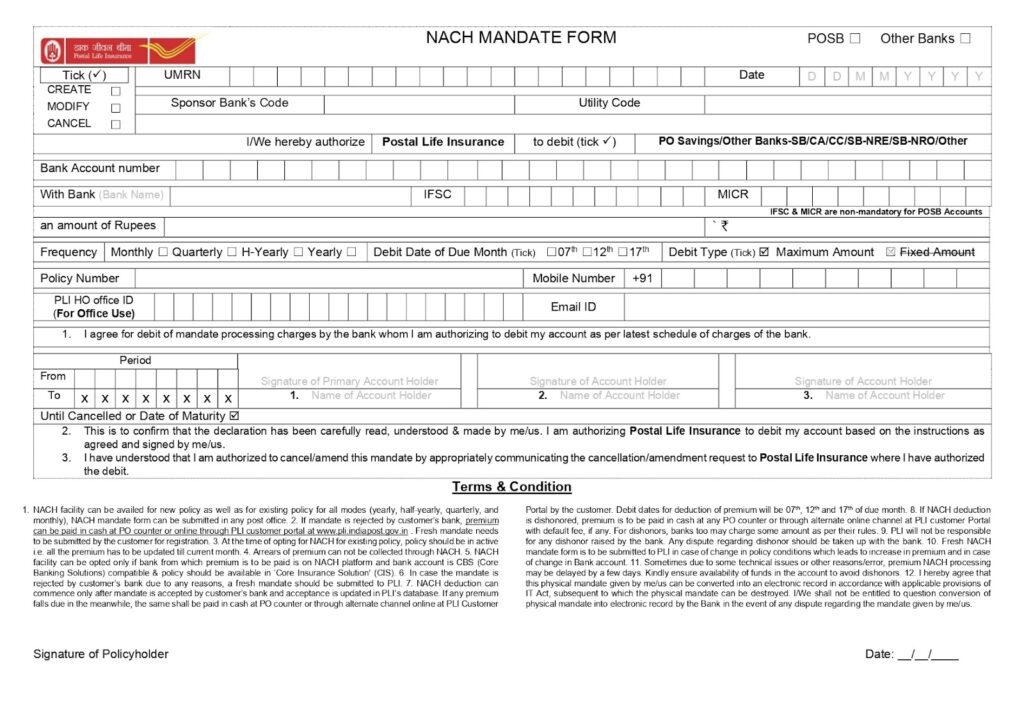

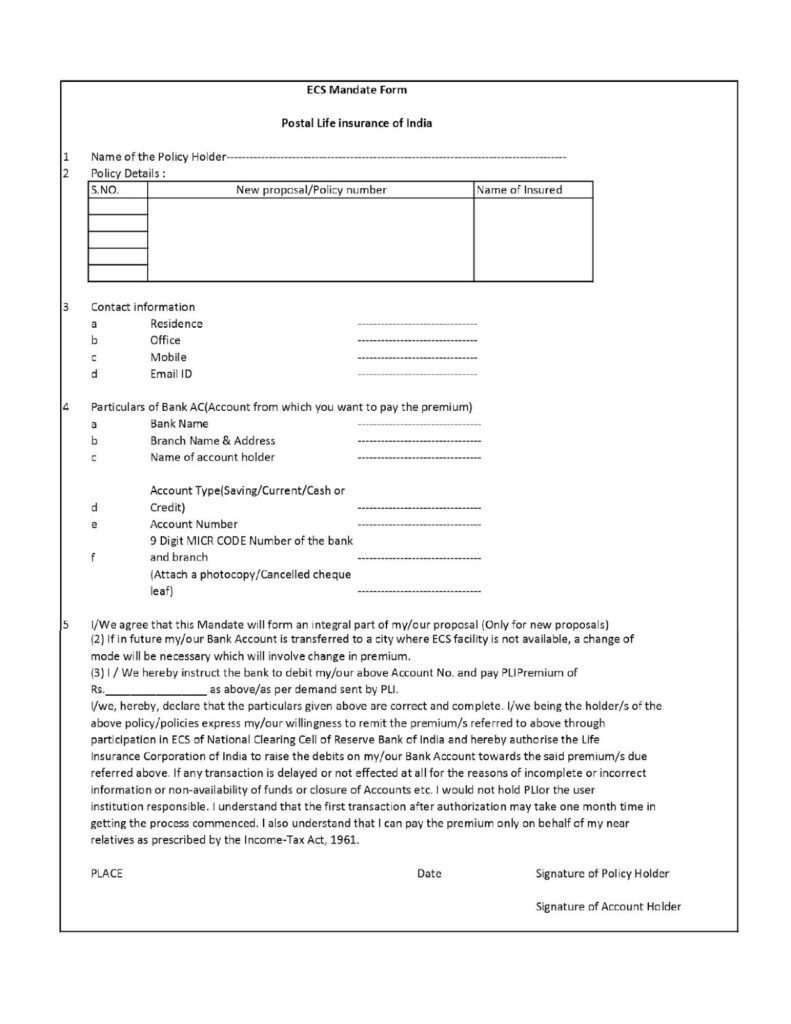

PLI customer can choose to standing instructions (SI Mandate) from any of their bank accounts or Post Office bank account to automatically education of the monthly premium of their PLI policy(ies) every month on selected dates i.e 07th or 12th or 17th of the month.

PLI customers before submitting of PLI Standing Instruction (SI) mandate form, must read the instructions carefully given at the end.

PLI Standing Instruction (SI) forms

PLI Premium Payment Standing Instructions(SI) Mandate Form through SBI- New Mandate Creation- Modify existing Mandate or Cancel the Existing Mandate

PLI Premium Payment Standing Instructions(SI) Mandate Form from POSB

PLI Premium Payment Standing Instructions(SI) ECS Mandate Form

Debit dates for deduction of premium will be the 07th, 12th, and 17th of due month.

PLI Automatic Premium Deduction Facility- PLI SBI NACH – Know Important Points

- NACH facility can be availed for new policy as well as for existing policy for all modes (yearly, half-yearly, quarterly, and monthly), NACH mandate form can be submitted in any post office.

- A customer walks into the Post office and wishes to change his/her billing method to NACH.

- On receipt of the request, the Post Office user will get the NACH mandate form filled from the customer and verify the bank particulars & other details provided therein as per cancelled cheque leaf with pre-printed name in proof of the customer’s bank account or the first page of the passbook obtained as part of supporting document and details of the policy available in the McCamish.

- If the mandate is rejected by customer’s bank, premium can be paid in cash at PO counter or online through PLI customer portal at www.pli.indiapost.gov.in & Fresh mandate needs to be submitted by the customer for registration.

- At the time of opting for NACH for existing policy, policy should be in active i.e. all the premium has to be updated till current month.

- Arrears of premium can not be collected through NACH.

- NACH facility can be opted only if bank from which premium is to be paid is on NACH platform and bank account is CBS (Core Banking Solutions) compatible & policy should be available in ‘Core Insurance Solution’ (CIS).

- In case the mandate is rejected by customer’s bank due to any reasons, a fresh mandate should be submitted to PLI.

- NACH deduction can commence only after mandate is accepted by customer’s bank and acceptance is updated in PLI’s database. If any premium falls due in the meanwhile, the same shall be paid in cash at PO counter or through alternate channel online at PLI Customer Portal by the customer.

- Debit dates for deduction of premium will be 07th, 12th and 17th of due month.

- If NACH deduction is dishonored, premium is to be paid in cash at any PO counter or through alternate online channel at PLI customer Portal with default fee, if any. For dishonors, banks too may charge some amount as per their rules.

- PLI will not be responsible for any dishonor raised by the bank. Any dispute regarding dishonor should be taken up with the bank.

- Fresh NACH mandate form is to be submitted to PLI in case of change in policy conditions which leads to increase in premium and in case of change in Bank account.

- Sometimes due to some technical issues or other reasons/error, premium NACH processing may be delayed by a few days. Kindly ensure availability of funds in the account to avoid dishonors.

- For cases where mandate has been registered, the current month premium has to be received in cash or previous set mode only. The newly set premium payment mode will be applicable from next cycle only.

- NACH functionality will be for collection PLI/RPLI subsequent premium only.

- If amount is not deducted from account due to any reason as per NACH schedule opted, customer has the provision to pay through cash/cheque /online for that particular period.

- If premium is not paid for that period through any other mode, request file for collection of premium through NACH will not be shared with the bank for this particular policy in the subsequent billing period.

- Post-registration of NACH, if customer approaches counter to pay in advance, he would be able to do so. However, in such scenario, the PTD will be updated and such policies will not be considered for deduction of premium through NACH for that particular months for which advance premium has been received.

- For policies that already exist in system, status for processing the billing method change request would always be done on policies with Active(AP) status i.e premium payment upto date and no default in the policy or due .

- If the customer approaches for stopping NACH, cancellation of the registered mandate will be done by PLI and thereafter billing method change request is to be indexed and processed in system as cash etc..

- In case of any claim (terminating event such as maturity, death, surrender) NACH would be terminated automatically in system. However, the mandate registered in the with SBI portal also needs to be cancelled by the PLI CPC.

- In case of cancellation or modification in registered mandate due to changes in existing collection mode, bank details etc, a fresh physical mandate allotting a fresh Unique Reference Number need to be obtained from the customer for registration of cancellation/modification in SBI portal, such modified debit mandates would carry old Unique Identification Number as well as new Unique Identification number to be written on right hand upper corner of mandate form for future references.