LIC’s Amrit Baal is a Non-Linked, Non-Participating, Individual, Savings, Life Insurance an Endowment plan with Guaranteed Additions of Rs 80/- per Rs.1000/- per year. LIC Amrit Baal Childern Plan is designed by LIC to plan the future saving and to meet higher educational and other needs of your children. Here we will provide a LIC Amritbaal children Plan 874 – Premium and Maturity Calculator so that you can chose the correct amount for your children’s future.

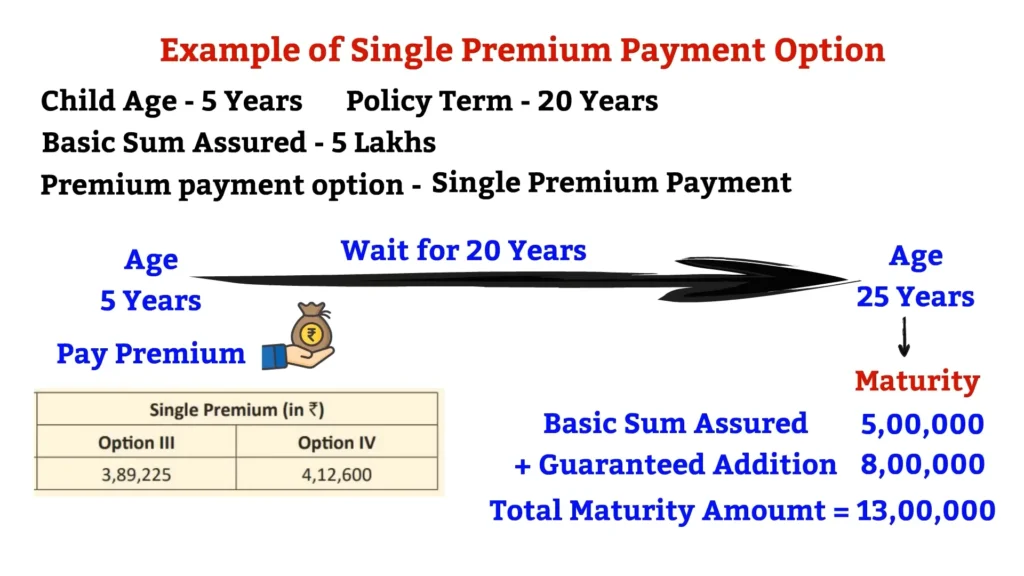

Under LIC Amrit Baal Childern Plan, for premium payment under this plan there is two option available one is Limited Premium with premium payment term of 5, 6 or 7 years and another option to pay the premium is on one installments/Lump sum (Single Premium).

Further the proposer will have an option to choose death benefit option in while submitting the LIC Amrit Baal Childern Plan proposal as “Sum Assured on Death” as further two options available under each mode of premium payment of Limited Premium and Single Premium payment.

LIC Amrit Baal Childern Plan can be purchased Offline through agent /other intermediaries including Point of Sales Persons-Life Insurance (POSP-LI) / Common Public Service Centers (CPSC-SPV) as well as Online directly through website www.licindia.in.

LIC Amritbaal Plan (874): Key Features

Grow your savings: Earn guaranteed additions of Rs. 80 per Rs. 1,000 every year throughout the policy term, helping your savings grow steadily.

Plan for your child’s future: Secure funds for your child’s higher education, marriage, or other important milestones.

Flexible payment options: Choose between paying premiums in installments over 5, 6, or 7 years (limited premium payment period) or pay a one-time lump sum (single premium).

Tailored life insurance: Select the level of life insurance coverage that best suits your child’s needs.

Child protection: Opt for the premium waiver rider to ensure premium payments continue even if you’re unable to do so, safeguarding your child’s future financially.

Tax benefits: Enjoy tax savings on premiums paid under Section 80C and receive the maturity amount tax-free under Section 10(10D).

Easy premium payment modes :- Choose between single or limited premium payment options.

Maturity periods :- Select the maturity age between 18 and 25 years to align with your child’s future needs.

Death benefit option:- Receive the maturity benefit in installments if desired.

Loan Facility:– Access loan benefits with a special 1% interest rate concession for policies on girl children.

Available online /Offline mode:-Consult an LIC agent or visit a branch for more details and personalized advice.

Eligibility Conditions LIC Amritbaal Plan (874):

- Entry Age:

- Minimum: 30 days old

- Maximum: 13 years (last birthday)

- Maturity Age:

- Minimum: 18 years (last birthday)

- Maximum: 25 years (completed)

- Policy Term:

- Limited Premium Payment: 10 to 25 years

- Single Premium Payment: 5 years

- Premium Payment Term:

- Limited Premium Payment: 5, 6, or 7 years

- Single Premium Payment: Single payment

- Sum Assured:

- Minimum: Rs. 2,00,000

- Maximum: No limit (subject to underwriting approval)

- Sum Assured Multiples:

- Up to Rs. 24,00,000: multiples of Rs. 25,000

- Above Rs. 24,00,000: multiples of Rs. 50,000

Guaranteed Additions:

- Earn guaranteed additions of Rs. 80 per Rs. 1,000 sum assured every year throughout the policy term.

Riders:

- Optional riders available, such as premium waiver rider for child safety.

Tax Benefits:

- Premiums paid qualify for tax deduction under Section 80C of the Income Tax Act.

- Maturity benefit received is partially taxable.

Death Settlement Options:

- Receive the maturity benefit as a lump sum or in installments over 5, 10, or 15 years.

Loan Facility:

- Loan available in the policy

Surrender Benefit:

- Surrender benefit available in the policy

Benefits under the LIC Amritbaal children Plan 874 –

Maturity Benefit LIC Amritbaal children Plan 874:

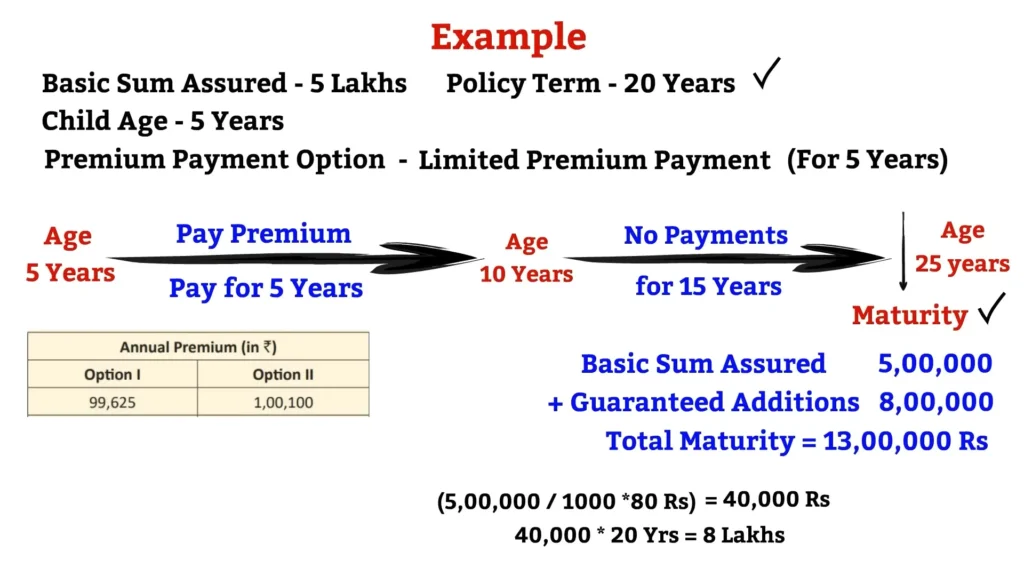

Under LIC Amritbaal children Plan 874 on surviving the the life assured on the fixed maturity dates full sum assured along with Guaranteed addition shall be payment to the insurant.

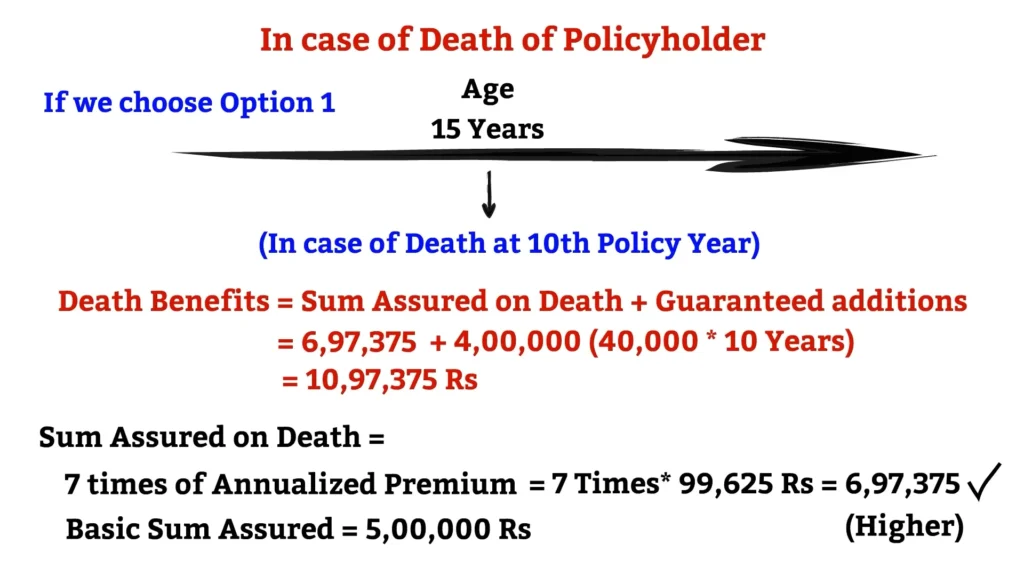

LIC Amritbaal children Plan 874 Death Benefit:

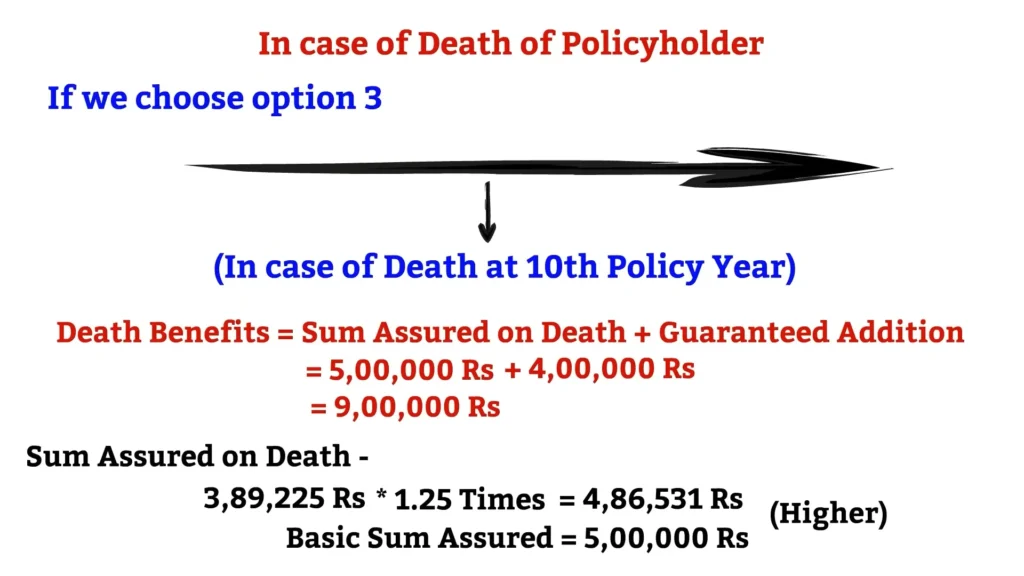

In case of unfortune death of the insurant , death benefit will be available to the nominee. The proposer will have an option to choose “Sum Assured payable on Death” of insurant as per the two options available under each of Limited Premium and Single Premium payment plan.

The Proposer has to choose one of the options at the time of submission of proposal for LIC Amritbaal children Plan 874 as under :-

| Premium Payment | Option | Sum Assured on Death |

|---|---|---|

| If the insurant expire before the date of commencement of Risk. | An amount equal to the total amount of premium paid – (Taxes + Extra premium + Rider premium) shall be payable to nominee of policy only | |

| If Death policy holder died After the date of commencement of Risk. | Sum Assured + Accrued Guaranteed Bonus will be payable to nominee suject to :- Sum Assured on death is :- | |

| Limited Premium Payment Plan | Option-I | Higher of • 7 times of Annualized Premium; or • Basic Sum Assured |

| Option-II | Higher of • 10 times of Annualized Premium; or • Basic Sum Assured | |

| Single Premium Payment Plan | Option-III | Higher of • 1.25 times of Single Premium; or • Basic Sum Assured |

| Option-IV | 10 times of Single Premium |

Guaranteed Additions for In-force policy:

Under LIC Amritbaal children Plan 874 in case policy remain in in-force , the Guaranteed Additions shall accrue at the rate of Rs. 80 per thousand of the Basic Sum Assured at the end of each policy year from the commencement of the policy period till the end of Policy Term.

In case of On death of Life Assured during the Policy Term under an in-force policy, the Guaranteed Additions in the year of death shall be payable to the nominee for full policy year.

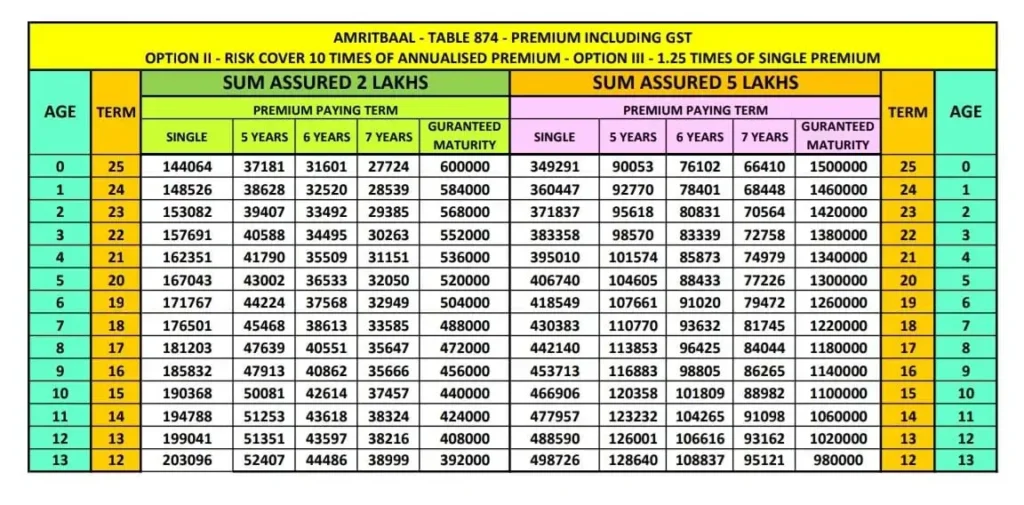

LIC Amrit Baal Plan 874 – Premium Chart

LIC Amritbaal Children Plan 874 – Maturity Calculator

LIC Amritbaal Children Plan 874 – Premium and Maturity Calculator

Death Claim Options Available Under LIC Amritbaal Children Plan 874:

Instead of receiving the death benefit as a lump sum, beneficiaries can choose to receive it in installments over 5, 10, or 15 years. This option is available for both in-force and paid-up policies.

Who can choose this option?

- The policyholder during the minority of the life assured.

- The life assured themselves, aged 18 years and above.

What portion of the benefit can be received in installments?

- The entire death benefit or a part of it.

How often are installments paid?

- You can choose to receive installments yearly, half-yearly, quarterly, or monthly.

Minimum installment amount:

- Monthly: Rs. 5,000

- Quarterly: Rs. 15,000

- Half-yearly: Rs. 25,000

- Yearly: Rs. 50,000

Maturity Benefit Options Available Under Lic Amritbaal Children Plan 874 :

Instead of receiving the maturity benefit as a lump sum, you can choose to receive it in installments over 5, 10, or 15 years. This option is available for both in-force and paid-up policies.

Who can choose this option?

- The policyholder during the minority of the life assured.

- The life assured themselves, aged 18 years and above.

What portion of the benefit can be received in installments?

- The entire maturity benefit or a part of it.

How often are installments paid?

- You can choose to receive installments yearly, half-yearly, quarterly, or monthly.

- To be opt at least 3 month before the maturity

- Once exercised no alteration will be allowed.

- During the death of the installment nominee will continue to received the installment amount.

Minimum installment amount:

- Monthly: Rs. 5,000

- Quarterly: Rs. 15,000

- Half-yearly: Rs. 25,000

- Yearly: Rs. 50,000

Rebate in online purchase of LIC Amritbaal children Plan 874 :-

Rebates are offered for purchasing the plan online or through the Corporation’s Insurance Scheme (CIS):

- Limited Premium Payment (Option I & Option II): 10% rebate on the tabular annual/single premium.

- Single Premium Payment (Option III & Option IV): 2% rebate on the tabular annual/single premium.

Loan Facility under LIC Amritbaal children Plan 874 :-

Eligibility:

- Regular Premium Payment: Loan available after 2 full years of premium payment.

- Single Premium Payment: Loan available after 3 months from policy completion or free-look period expiry, whichever is later.

Loan Limit:

- Maximum loan amount ensures the annual interest payable on the loan does not exceed 50% of the annual annuity amount.

- Loan amount cannot exceed 80% of the surrender value (including any top-up annuity tranches).

Interest on Loan LIC Amritbaal children Plan 874 :-

Normally 9.5 % pa compounded half yearly basis , for girl child policy normally 8.5% .

Premium Rider Option in LIC Amritbaal children Plan 874 : Premium Waiver Benefit( PWB)

- Policy holder can opt anytime during the minority of the child provided minimum premium term is at least 5rs

- If PWB rider id opted and death occur during the rider term, future premiums under the policy shall be waived.

Surrender of LIC Amritbaal children Plan 874

Allowed after policy acquired paid up value

- Limited Premium Plan :- After 2 full yr premium have been paid by the policy holder

- Single Premium Plan :- Any time during the policy term .

LIC Amritbaal Plan: Key Points on Risk Coverage and Policy Details

Risk Coverage:

- The policy provides life insurance coverage throughout the entire policy term.

Commencement of Risk:

- For children under 8 years old, risk coverage starts earlier of:

- 2 years from policy issuance

- 8 years old

Locking Period:

- The plan offers a free locking period of 2 years, during which you cannot surrender the policy.

Backdating:

- Backdating is allowed within the same financial year, but not before the plan’s launch date.

Revival:

- You can revive a lapsed policy within 5 years of the first unpaid premium by paying all due premiums.

Proposal Forms:

- This plan uses proposal forms No. 300 and 360.

Cooling-off Period:

- You have 15 days from receiving the policy to return it if you’re not satisfied with the terms and conditions.

For children under 8 years old, the policy’s risk coverage starts earlier of:

- 2 years from the date the policy is taken out.

- The child reaching 8 years old.

- This means that if the child reaches 8 years old before 2 years have passed since the policy was issued, the risk coverage will begin at age 8.

Vesting of the Policy:

The policy automatically vests in the life assured (child) upon reaching 18 years of age. This means that ownership and control of the policy, including any future benefits, transfers to the child at this point.

Can you buy LIC Amritbal Children’s Policy online?

Yes you can buy LIC Amritbal Children’s policy online , the link for online purchased are normally available at LIC portal , online purchase there is rebate of the some amount. However to get the after sales service you may also cosider the other off line mode.