Postal Life Insurance (PLI) Surrender Value Calculator

What Is the Surrender Value of PLI Policy?

How to Calculate the Surrender Value online?

Before applying for the surrender of your PLI/RPLI policy, you have to check the PLI surrender value calculator online through the customer portal. The process for online surrender value calculation will as under:-

Here’s a step-by-step guide on how to initiate a policy surrender request through the PLI customer portal:

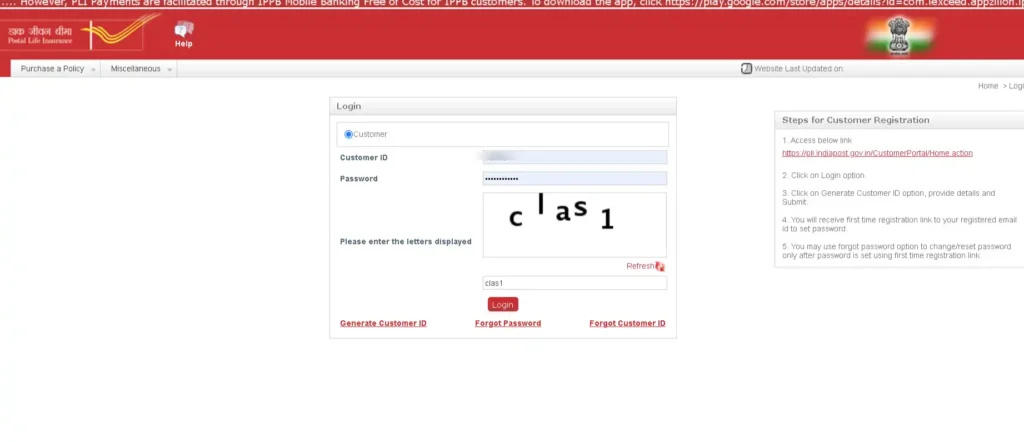

1. Access the Portal:

- Open a web browser on your computer or mobile device.

- Visit the official PLI customer portal website: https://pli.indiapost.gov.in/CustomerPortal/PSLogin.action

2. Log In:

- Enter your Customer ID and Password in the designated fields.

- If you’re not yet registered, click the “Generate Customer ID” option and follow the prompts.

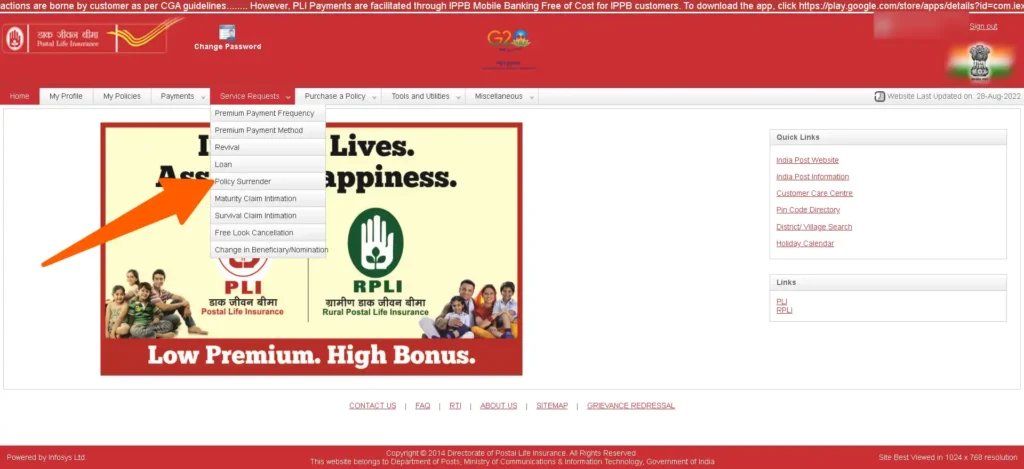

3. Navigate to Service Request:

- Once logged in, locate the “Service Request” tab or section on the portal’s homepage.

- Click on it to access the service request options.

4. Select Policy Surrender:

- Within the Service Request section, find the option for “Policy Surrender.”

- Click on it to proceed with the surrender process.

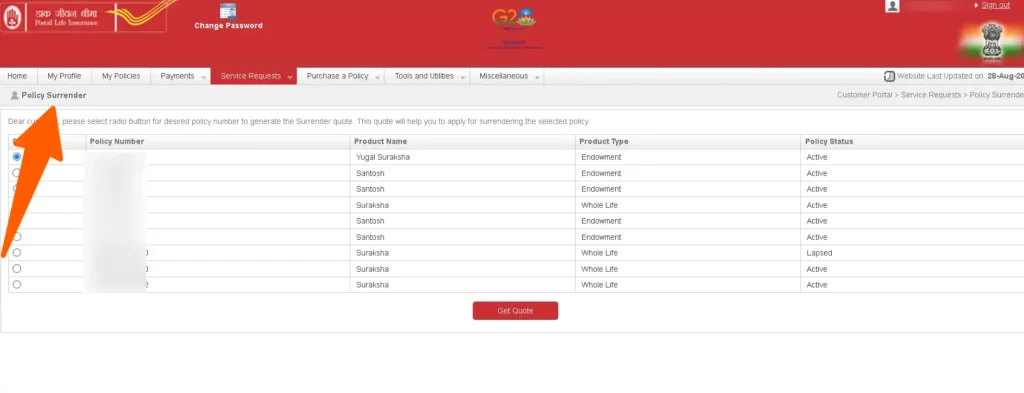

5. Choose the Policy:

- You’ll likely be presented with a list of your active PLI policies.

- Carefully select the specific policy you intend to surrender and click on get quote

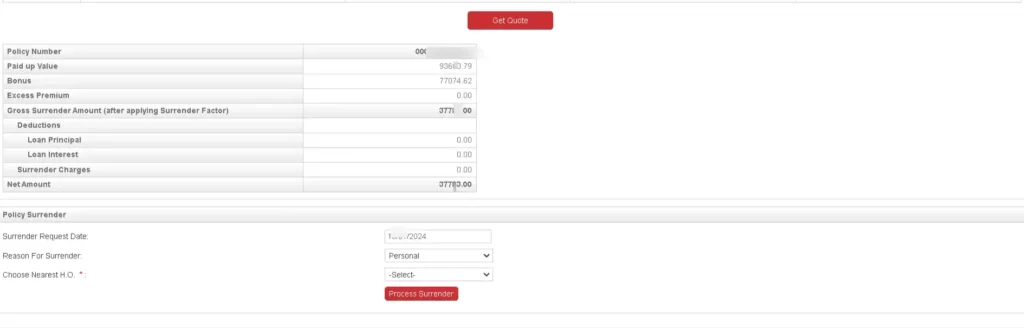

6. Get Quote:

- After choosing the policy, locate and click the “Get Quote” button or link.

- This should initiate the generation of a surrender quote, which will provide details about the estimated surrender value and other relevant information.

7. Review and Confirm:

- After receiving the quote, thoroughly review the terms, conditions, and surrender value.

- If you’re satisfied and wish to proceed, follow the prompts on the portal to confirm your surrender request.

- Here it will show all your policies eligible for surrender. Select the policy for surrender. It will show the surrender value of your policy.

PLI Surrender Value Calculator in Excel-

Here you can calculate your Postal Ife insurance policy value in excel. PLI Surrender value Calculator in MS Excel:–

Calculator in Excel at the end please check there

Table for Calculation of Surrender Value of Postal Life Insurance Policy(PLI) PDF:-

Should you surrender your PLI Policy

Main advantages of Using the PLI Policy Surrender Value Calculator:-

-

Convenience and Accessibility:

- It’s a free, online tool that can be accessed from anywhere, anytime, using a computer or mobile device.

- This eliminates the need to physically visit a PLI office or consult a financial advisor to obtain surrender value information.

-

Ease of Use:

- The calculator is designed to be user-friendly, requiring only basic policy details like policy number, date of commencement, and sum assured.

- It generates quick results, making it simple to understand and use even for those with limited financial knowledge.

-

Transparency and Accuracy:

- The calculator provides a transparent estimate of the surrender value based on PLI’s official surrender value factors.

- This eliminates guesswork and ensures policyholders have accurate information to make informed decisions.

-

Comparison Tool:

- Policyholders can use the calculator to compare the surrender values of different PLI policies they hold.

- This helps in identifying the policy that offers the highest surrender value, potentially optimizing financial decisions.

-

Financial Planning:

- Knowing the surrender value can aid in financial planning and decision-making.

- Policyholders can assess if surrendering a policy aligns with their current financial needs or if alternative options, like a loan against the policy, might be more suitable.

-

Informed Decisions:

- By understanding the surrender value, policyholders can make well-informed decisions about their policies.

- This could involve surrendering a policy to meet immediate financial needs, switching to a different policy with better benefits, or continuing the policy as planned.

Which type of Postal Life Insurance policy can be surrendered?

- Sumangal – Anticipated Endowment Assurance and Child Policy in PLI can not be surrendered. All other PLI Policies can be surrendered after 3 Yrs.

- In RPLI Gram Sumangal – Anticipated Endowment, Child Policy and Gram Priya cannot be surrendered.

What Documents are required for surrendering a PLI/RPLI Policy:-

- Surrender Request Form

- Policy Bond

- Premium Receipt Book

- D.O.C for last one year in case of Pay Recovery

- loan repayment receipt book( in case of existing Loan on policy)

- Duplicate Policy Bond(in case of document lost)

- Indemnity Bond if duplicate bond not available.

PLI surrender value calculation after 3 years:-

Normally PLI Policy can be surrendered after 3yr, however, no bonus is added before 5yr of the surrender of the policy. First few years, the premium goes to risk fund hence surrender value after 3 yr is very nominal. Normally 30%-40% of the premium is paid.

What is the formula for the surrender value of Postal Life Insurance Policy(PLI)?

Surrender value= Paid up value +Bonus x surrender Factor as per table.

** Paid up value = Number of premium paid x sum assured/ Total number of premium payables.

Age – Age at the time of surrender application.

For Example:-

Policy acceptance date 01.01.2015

Age at the time of policy acceptance:- 25 yrs

Your date of birth is 26.10.1990

Date of surrender:- 20.01.2022

Sum assured of policy Rs. 200,000/-

Policy type- Santosh EA-55

Age at the time of surrender: – 32 yrs

Surrender factor as per table – Age 32, Policy EA-55 Factor is :- 0.339 ( at s.no 89 of the table in pdf)

Paid-up value: – 200000×84/360=46666

Bonzs on paid-up value – (2015 to 2021) 7yrs on paid up value i.e 46666 = 2426×7=16982 (52 per 1000)

Surrender value= Paid up value +Bonus x surrender Factor as per table.

Surrender value =46666+16982=63648×0.339=21576/-

Postal Life Insurance (PLI ) Surrender Value Calculation Sheet:-

Normally when you apply for surrender a PLI policy, the post office sends a surrender value calculation sheet to you to confirm the surrender value acceptance. In this sheet surrender value calculation is available, however, after the final surrender of your policy a surrender value calculation sheet is also generated. It surrender value is correctly calculated by the system.

Postal Life Insurance (PLI )Surrender Value After 5 Years:-

If PLI policy is surrendered after 5 yrs it includes the bonus as a bonus is payable only after 5yrs. Normally initial year of policy is mostly a premium amount put in the risk fund, however, as the policy premium period increases our risk cover also increases year by year. ( Bonus + Sum assured) Like Policy Sum assured 5 lakh:-

1yrs – 500,000+ 0 bonus total Risk Cover- 5 lakh

5th year – 500,000+ 130000 (5200 per lakh)= 6,30,00 Risk cover.

So initially mostly premium goes to the risk cover fund, and PLI is liable to pay the premium from day one of the acceptance of the policy, hence surrender value is much less and allowed only after 3yr.

Postal Life Insurance (PLI )surrender value after 10 years:-

If the PLI policy is surrendered after 10 yrs and your total period of the policy is 20 yrs, surrendering a policy after half the period of the total term may recover your paid premium. However, during this period it covers your life risk.

Hence surrender is not desirable and it is a loss to your investment and life goes with risk cover.

However if due to financial condition, you are thinking for surrendering your policy, explore the following option:-

- Think of taking a loan against the policy instead of surrendering, the loan amount will be less as 80% of the surrender value.

- If a premium is too much, ask PLI to decrease the premium or sum assured of the policy.

- If the period of premium payment is too long say EA/60, the premium payment period may be decreased however premium will increase.

PLI Surrender Value Calculator in Excel- Best view use in Desktop