Introduction- Searching for Best PLI Plan

If you are searching to buy a PLI policy and want to know which plan is best in Postal Life Insurance (PLI), we will explore the various plans offered by PLI, helping you make an informed decision on which plan suits your needs best.

Understanding Postal Life Insurance (PLI)

2.1 History and Evolution

Postal Life Insurance (PLI) originated on February 1st, 1884, initially crafted as a welfare initiative for postal workers. Its scope expanded in 1888 to include employees of the Telegraph Department.

Notably, in 1894, PLI took a progressive step by offering insurance coverage to female employees of the P & T Department, pioneering gender inclusivity in insurance at a time when it was uncommon.

As the oldest life insurer in the country, PLI has witnessed remarkable growth, transitioning from a mere few hundred policies in 1884 to an impressive count of over 50 lakh policies by March 31st, 2023.

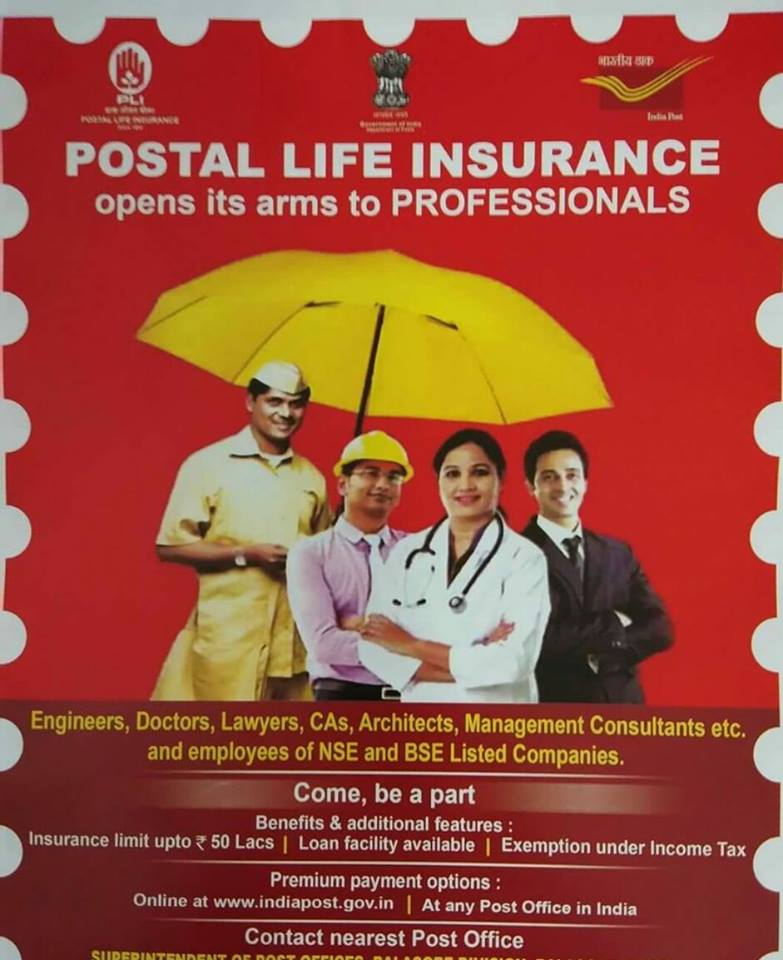

Presently, PLI extends its coverage to a diverse range of individuals, encompassing employees of Central and State Governments, Defense and Para-Military Services, Public Sector Undertakings, Banks, Educational Institutions, Local Bodies, as well as professionals like doctors, engineers, chartered accountants, MBAs, lawyers, and employees of companies listed with the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) and Graduate from any recognized Universities in India.

2.2 Types of Plans

Before exploring the specific plans, it’s essential to understand the diverse range offered by PLI. From Whole Life Insurance to Children’s Policies, each plan caters to unique requirements.

Factors to Consider Before Choosing a Best PLI Plan

3.1 Coverage Amount

Determining the right coverage amount is crucial. We’ll discuss how to assess your needs and choose a plan that provides adequate financial protection and suits your financial needs

3.2 Premium Rates

Comparing premium rates among different plans ensures you find a balance between affordability and comprehensive coverage.

3.3 Maturity Benefits

Understanding the maturity benefits of each plan is vital for long-term financial planning. We’ll explore how PLI plans offer security beyond the policy period.

3.4 Conversion, Loan and Surrender

Exploring additional options like Increasing or decreasing premium amount, sum assured, maturity period, facility for surrender, and loan in the plan will allow you to customize your policy based on specific needs.

Popular PLI Plans Explained

PLI offers 6 plan vanilla plans, here we will discuss the detail features of every PLI plan so that based on their features you can select the best PLI plan. However many PLI customer choose more than one plan as per their requirement.

4.1 Whole Life Insurance Plan Feature

| Feature | Details |

| Coverage Type | Life insurance with maturity benefit at age 80 |

| Eligibility | Age 19-55 |

| Sum Assured | Minimum ₹20,000, Maximum ₹50 lakhs |

| Death Benefit | Sum assured + accrued bonus |

| Maturity Benefit | Sum assured + accrued bonus at age 80 |

| Bonus | After 3 years, with a proportionate bonus on reduced sum assured (no bonus before 5 years) |

| Loan Facility | Available after 4 years |

| Surrender Option | After 3 years, with proportionate bonus on reduced sum assured (no bonus before 5 years) |

| Conversion | Convertible to Endowment Assurance Policy by age 59 |

| Premium Payment Age | Choose age 55, 58, or 60 |

| Premium payment mode | Monthly only |

4.2 Convertible Whole Life Assurance (Suvidha) Plan Feature

| Feature | Details |

|---|---|

| Coverage Type | Initially Whole Life, convertible to Endowment after 5 years |

| Maturity Benefit: | * Whole Life: Sum assured + accrued bonus at age 80 |

| Conversion Window: | After 5 years, but before 6 years of policy starting |

| Death Benefit: | Sum assured + accrued bonus, payable to beneficiary |

| Eligibility: | Age 19-55 |

| Sum Assured | Minimum ₹20,000, Maximum ₹50 lakhs |

| Loan Facility: | Available after 4 years |

| Surrender Option: | After 3 years, with a proportionate bonus on reduced sum assured (no bonus before 5 years) |

| Bonus: | * Whole Life: ₹76 per ₹1000 sum assured per year (as of the last declaration) |

| Additional Notes: | * If not converted by year 6, the policy continues as Whole Life. |

4.3 Endowment Assurance( Santosh ) Plan Feature

| Feature | Details |

|---|---|

| Coverage Type | Life insurance with guaranteed maturity benefit |

| Maturity Age Options | 35, 40, 45, 50, 55, 58, & 60 years |

| Eligibility | Age 19-55 |

| Sum Assured | Minimum ₹20,000, Maximum ₹50 lakhs |

| Maturity Benefit | Sum assured + accrued bonus at chosen maturity age |

| Death Benefit | ₹52 per ₹1000 sum assured per year (as of the last declaration) |

| Bonus | After 3 years, with proportionate bonus on the reduced sum assured (no bonus before 5 years) |

| Loan Facility | Available after 3 years |

| Surrender Option | Monthly , Quarterly, Half Yearly and Yearly mode are available |

| Premium Payment Age | Choose age 35, 40, 45, 50, 55, 58, & 60 years |

| Premium payment mode | Monthly , Quarterly, Half Yearly and Yearly mode available |

4.4 Anticipated Endowment Assurance (Sumangal) Plan Feature

| Feature | Details |

|---|---|

| Policy Type | Money Back Policy |

| Sum Assured | Minimum ₹20,000, Maximum ₹50 lakhs |

| Suitability | Ideal for individuals seeking periodic returns |

| Survival Benefits | Paid periodically to the insurant |

| Not considered in the event of unexpected death | |

| Death Benefit | Full sum assured with accrued bonus payable to the assignee, nominee, or legal heir, irrespective money back amount already paid to insurant. |

| Policy Term | 15 years and 20 years |

| Age Criteria | Minimum Age: 19 years |

| Maximum Age at Entry: 40 years for 20 years’ term policy | |

| Maximum Age at Entry: 45 years for 15 years’ term policy | |

| Survival Benefits Schedule | 15 years Policy: 20% each on completion of 6 years, 9 years & 12 years, and 40% with accrued bonus on maturity |

| 20 years Policy: 20% each on completion of 8 years, 12 years & 16 years, and 40% with accrued bonus on maturity | |

| Last Declared Bonus | ₹48/- per ₹1000 sum assured per year |

| Premium payment mode | Monthly only |

| Loan Facility | No loan facility in this policy |

| Surrender Option | No surrender facility in this policy |

4.5 Children’s Policy Plan Feature

Examining the unique features of Children’s Policies, ensuring a secure future for your child’s education and other needs.

| Feature | Description |

|---|---|

| Policy Type | Child Policy |

| Coverage | Children of policy-holder (parent) |

| Maximum Children | 2 |

| Age Eligibility | 5-20 years |

| Maximum Sum Assured | ₹3 lakhs or parent’s sum assured (whichever is less) |

| Parent Age Limit | 45 years |

| Premium Payment | None on child’s death |

| Full Benefit Payment | On policy term completion |

| Premium Payment by Parent | Yes |

| Loan | Not available |

| Paid-up Option | Available after 5 years of continuous premium payment |

| Surrender | Not available |

| Medical Examination | Not required for child |

| Risk Start | Day of proposal acceptance |

| Bonus Rate | Same as Endowment policy (Santosh) – ₹52 per ₹1000 sum assured per year |

4.6 Joint Life Assurance Plan Feature

Joint Life Assurance for couples looking to secure their financial future together.

| Feature | Description |

|---|---|

| Policy Type | Joint Life Endowment Assurance |

| PLI Eligibility | One spouse must be eligible for PLI policies |

| Life Cover | Both spouses, for sum assured + accrued bonus |

| Premium Payment | Monthly mode |

| Minimum Sum Assured | ₹20,000 |

| Maximum Sum Assured | ₹50 lakhs |

| Age at Entry (Minimum)-(Maximum) | 21 years-45 years |

| Age Limit (Elder Spouse) | 45 years (maximum) |

| Couple Age Range | 21-45 years |

| Policy Term (Minimum)-(Maximum) | 5 years-20 years |

| Loan Facility | Available after 3 years |

| Surrender | Available after 3 years |

| Surrender Bonus | None before 5 years |

| Surrender Bonus (Reduced Sum Assured) | Proportionate |

| Death Benefit Recipient | Surviving spouse or main policyholder |

| Last Declared Bonus | ₹52 per ₹1000 sum assured per year |

Pros and Cons of PLI

5.1 Advantages

Postal Life Insurance (PLI) is a government-backed life insurance scheme in India offered by India Post. It has been around since 1884 and is known for its affordability, accessibility, and reliability. Here are key advantages of Postal Life Insurance:

1. Government Guarantee: PLI is backed by the Government of India, making it a safe and secure investment. This guarantee provides peace of mind knowing that your premiums and payouts are protected.

2. Wide Range of Plans: PLI offers a variety of plans to cater to different needs and budgets. Some popular plans include Whole Life Assurance, Endowment Assurance, Joint Life Endowment Assurance, and Child Policy. You can choose the plan that best suits your financial goals and risk appetite.

3. Affordable Premiums: PLI premiums are generally lower compared to private life insurance companies. This is because PLI backed by Govt. and use the largest postal network to reduce the cost. This makes PLI an attractive option for budget-conscious individuals. The main moto of PLI is low premium high bonus.

4. Easy to Purchase: PLI policies can be easily purchased through any post office in India. This makes it convenient and accessible for people living in rural and remote areas where private insurance companies may not have a presence.

5. Tax Benefits: Premiums paid for PLI policies are eligible for tax deduction under Section 80C of the Income Tax Act. This can help you save on your taxes and increase your overall returns.

6. Bonuses: PLI policies also offer the highest bonuses in the industry, which are additional payouts over and above the sum assured. These bonuses are declared periodically by the government and can significantly increase the value of your policy.

7. Loan Facility: Many PLI policies offer loan facilities after a certain period. This can be helpful in case of financial emergencies or unforeseen circumstances.

8. Largest postal network – Postal life insurance has the largest postal network for premium payment in any post office, in addition, Premiums can be paid through ECS, PLI customer portal or IPPB mobile app through SI mode every month with convenience.

Overall, Postal Life Insurance offers several advantages for individuals and families looking for a secure and affordable life insurance solution. With its government guarantee, wide range of plans, and attractive features, PLI is a viable option to consider for your life insurance needs.

5.2 Disadvantages of Postal Life Insurance

Addressing potential drawbacks, such as limited flexibility compared to private insurers.

Limited Investment Options: Unlike private life insurance plans, PLI doesn’t offer various investment options. Your premiums mainly go towards building a guaranteed sum and bonus, with limited exposure to market-linked returns. This can be a disadvantage if you seek higher potential returns than PLI’s traditional approach.

How to Select the Right PLI Plan for You

6.1 Assess Your Needs

Which Plan is best in Postal Life Insurance for you depends on your financial needs mainly, if you want regular money in intervals with full risk cover, then Money Bak is best for you, if you want coverage of your spouse in a single policy then Yugal Suraksha policy is best for your, if you want to risk cover in low premium with a high bonus then whole life is best for you, in addition, child future you may consider children policy.

6.2 Analyze Your Budget and Premium Payment Capacity

In addition to the above, while choosing the best PLI plan also check your monthly budget and premium payment capacity. It will avoid in future unnecessary loans and surrender of your policy.

6.3 Seek Professional Advice

Always seek all information from your insurance advisor about each PLI plan so that according to your financial goal, and future requirements, you can choose the correct PLI plan for you.

Comparing PLI with Other Insurance Options

8.1 Private Life Insurance Companies

A comparative analysis between PLI and private insurers, helping readers understand the unique advantages of each. This will also help you to select the best plan suitable for you as per your requirements.

8.2 Government-Sponsored Schemes VS PLI

Before selecting the best PLI plan also explore what other govt. back schemes available, however PLI is 100% backed by the govt. of India and is a blend of insurance, investment, and risk cover. All other products might not have all three components.

9.1 Tips for Maximizing PLI Benefits

Important Documents:

- Policy Number: 13 digits, needed for transactions and premium payments.

- Policy Bond: Required for claims and servicing events.

- Regular payments are crucial to avoid lapsing and losing coverage.

- Pay monthly in advance, ideally on the first day.

- The grace period is till the last working day of the month.

- Late fees apply for delayed payments.

- Register your mobile number and email for updates.

Premium Payment Options:

- Cash or cheque.

- Online payment.

- Over-the-counter payment at post offices.

- Electronic clearance system (ECS) through SBI

- Pay through salary deduction with employer consent.

- SI mode through IPPB app

Policy Transfer:

- Possible within India if you receive a job transfer. Any PLI service can be availed in any CPC in India irrespective of your original policy to any particular CPC.

Lapsing:

- Occurs if premiums are not paid within the grace period i.e. before the last day of the month’s due date.

- Requires more than six missed premiums for <3 year policies.

- Requires more than twelve missed premiums for > 3-year policies.

Nomination:

- Crucial to have a named beneficiary.

- Can be a close family member.

- Can be changed or added at any time.

Loan Facility:

- Available for policies in force for at least 3 years.

- Requires a minimum surrender value of INR 1000.

Enquiries an customer care:

- Call toll-free number 1800 180 5232/155232.

9.2 Review and Update

After selecting the best PLI plan and purchase, always keep updated yourself by visiting the PLI

9.3 Understanding Policy Terms

While selecting the best Postal Life Insurance Plan, policy terms should be checked carefully, like in the case Money back policy Loan and surrender facility is not available, in the case Whole life has a maximum bonus rate in India with low premium but the maturity period is at 80yrs.

Common Misconceptions about PLI

10.1 Limited Scope

Earlier there was a misconception about PLI that its plan is available for Govt. employees only, however recently PLI has expanded its clientele and now PLI plans are available to all professionals also.

10.2 Complex Procedures

Clarifying misconceptions regarding complex procedures associated with PLI applications, now all the PLI services are made online, you can access your PLI policy details online through PLI cusomer portal

PLI and Tax Benefits

Postal life insurance has tax benefits on its premium payment under section 80/c.

Conclusion- Which Plan is best in Postal Life Insurance?

In summary, choosing the right PLI plan requires careful consideration of individual needs and preferences. With its diverse range of plans and government backing, PLI stands as a reliable choice for those seeking financial security. However a per general trend PLI EA plan is best suited for all insurant and maximum policy issuance under this plan due to its premium payment, and maturity period flexibility.

Frequently Asked Questions (FAQs)

1. Can I switch between PLI plans?

A: No, However, PLI offers flexibility, allowing policyholders to switch between a Whole life assurance plan to an Endoment Plan based on their evolving needs

2. What sets PLI apart from private insurers?

A: PLI’s government backing, affordability, and reliability distinguish it from private insurers.

3. How do I avail tax benefits with PLI?

A: Premiums paid towards PLI plans are eligible for tax benefits under Section 80C of the Income Tax Act.

4. Are there any age restrictions for PLI plans?

A: PLI plans are typically available for individuals between the ages of a minimum of 19 years and Max-55 years. 5. Can I surrender my PLI policy A- Yes except Child policy and money-back policy.