How To Revive PLI Policy Online?

Before we discuss how to revive your lapsed PLI Policy. We understand some basic terms for PLI revival rules when you check your policy online and its shows the policy status:-

# Policy in Force or Active” means a policy for which all the due premia have been paid regularly and such policy has neither become ‘void’ nor ‘lapsed.

Rules for Revival of PLI Policy:-

a) Policy for which any premium/premia have become due, not paid either on the first day of the month for which the premium is due or within the period of grace allowed as per Rule,( at the end of the month) the policy shall become void.

b) Policy-holder of a void policy can reinstatement/deposit of his/her policy premium within a period not later than six months from the date of the first unpaid premium i.e maximum 6 months unpaid premium can be deposited without formal revival process subject to continued insurability of the life at the time of payment of arrears, and for that, the insured person shall submit the declaration of good health application at Post Office Counter.

c) Policy holder can deposit all the arrears of premium/premia till the date of payment along with interest thereon at the rates.

(x) If the premium has not been paid for more than 6 months then the revival process needs to follow as described below.

(B) Policy status has Lapsed if the policy period is more than 36 months and premia is not paid:-

a) In case of a policy period is more than 36 month and if any premium/premia have become due after such period, not paid either on the first day of the month for which the premium is due or within the period of grace allowed, the policy shall cease to be active and treated as lapsed. In such case need to follow the revival process as given below (b).

b) However, if policyholder of a policy that has become inactive/lapsed (Premium not paid upto 12 Months) desiring reinstatement/revival of his/her policy within a period not later than twelve months from the date of the first premium remain unpaid, can deposit all the unpaid/due of premium/premia up to date of payment plus with interest thereon at the prescribed rates in the Post Office specified for the purpose of payment of premia in respect of such policy after submission of self-declaration of good health.

(x) If the premium has not been paid for more than 12 months (in case the policy is in force for more than 36 months) then the revival process needs to follow as described below.

So In case the policy premium is unpaid more than 6 months (A) above or unpaid premium more than 12 months (B) above i.e. x above. Policyholder needs to visit the Post office with the below-given documents for a formal revival of his policy.

The important documents like the revival application form, and medical certificate form for the revival of PLI policy is required for the revival of a lapsed policy is given below:-

The summary of the above revival procedure for PLI Policy is here for easy understanding:-

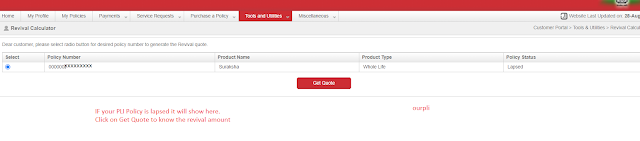

# How to Calculate PLI Policy Revival Amount Online:-

You can check your lapsed PLI/RPLI policy revival amount online, through your Customer Portal.Step-1 Login to the PLI customer portal and click on tools and utilities

Step-2 Click on the Revival calculator. It will show the policy eligible for revival only here.

Step-3 Selet the lapsed Policy and click on Get quote

Interest Amount

How can I revive my lapsed PLI policy?

· Pay your premium within a month for the full benefit of insurance. To avoid any delay always set the standing instruction through IPPB mobile app

The revival of a policy shall be allowed on any number of occasions during the entire term of the policy.

· a PLI Policy can be revived unless the said PLI policy has not attained the date of maturity and the life assured is insurable at the time of revival.

·A policy shall not be considered to have been revived unless an application for that purpose has been made and until the policy has been formally revived in writing.

· For the revival of RPLI policies, the same rules apply.

PLI Policy Revival Procedure:-

Also Read:-

# Documents required for revival of PLI Policy:-

a) PLI Reivial form- Revival Application Form.

b) Premium Receipt Book/ DDOs Certificate in casePay Policy.

PLI Revival Calculator:-

Check here Estimated Revival Amount:-

*Revival of pli policy clarification PLI Revival Medical Form PDF

FAQ:-

1. When do I need to revive my PLI/RPLI Policy?

A- If a premium is not paid for more than 6 months is policy is less than 36 months old. if the premium is not more than 12 months, if the policy is 36 month old, need formal revival.

2. What are the documents required for the revival of my Policy?

a) Revival Application form

b) Premium Receipt Book/ DDOs Certificate in Pay Policy

c) PLI Policy Revival Medical Certificate – Medical Certificate for the revival of PLI and witness from two respectable persons.

3, My Policy get lapsed, is there a benefit to reviving my Policy now?

A- Revival of PLI policy is always beneficial especially when your policy is old due to the high bonus rate earlier.

4. Can I pay my revival amount in Installments?

A- Yes you can contact to post office for installment revival, however, in this case, you must ensure to pay all installments without failure.

5. Where can I deposit my Revival documents?

A- You can deposit your revival documents to any Head Post office in India irrespective of your original policy documents in any other Head Post Office.

allowed on any number of occasions

during the entire term of the policy.

years should not have passed

from the date of the first unpaid premium

against such lapsed policy.

My policy premium is unpaid for the last 20 months ,can I revive ? There are two policies of 5 lakhs each . I am ready to pay the entire amount with interest

ok

Hi Nice Post! Term Life insurance Agent In Toronto policies provide high life cover at lower premiums. These fixed premiums can be paid at once or at regular intervals for the entire policy term or a limited period. Term Life insurance In Toronto