If you have any complaints regarding the PLI Policy and searching for how to register Postal Life Insurance complaints online, here we will discuss in detail the whole process to register a PLI complaint.

Register Postal Life Insurance Complaints– A Detailed process

1. Choose your method: You can file your complaint through various channels:

Register a Postal Life Insurance complaint -Online:

- Toll-free Number: Call the PLI Grievance Redressal Toll-free number: 1800-266-6868.

Register a Postal Life Insurance complaint Offline:

- Post Office: Visit any post office and submit your complaint in writing.

- Circle Public Grievances Nodal Officer: Contact the relevant Circle Public Grievances Nodal Officer for your region. You can find their contact details here:

2. Prepare your complaint:

- Before filing your complaint, gather all relevant documents, such as your policy number, policy document, communication records with PLI, and any other supporting evidence.

- Clearly state the nature of your complaint, including the specific issue you are facing, the date and time of the incident, and the names of any individuals involved.

- Be concise and factual in your complaint.

3. Submit your complaint:

- Follow the instructions specific to the chosen method mentioned above.

- When filing online, you’ll need to provide your basic information, contact details, and a detailed description of your complaint.

- If you submit your complaint in writing, ensure it is legible and addressed to the appropriate authority.

Step-by-step guide to Register Postal Life Insurance Complaints-

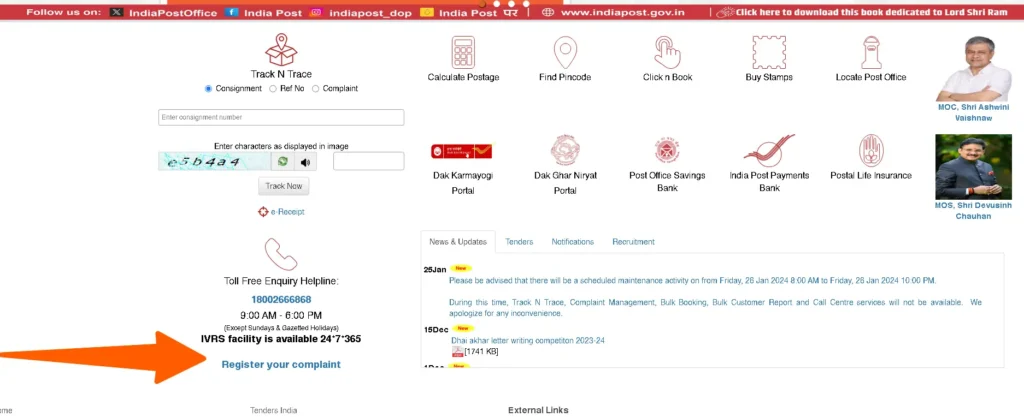

– Visit the official India Post website.

– Navigate to the ” Register Your Complaint” at home page.

– Select “Complaint Registration” from the options provided.

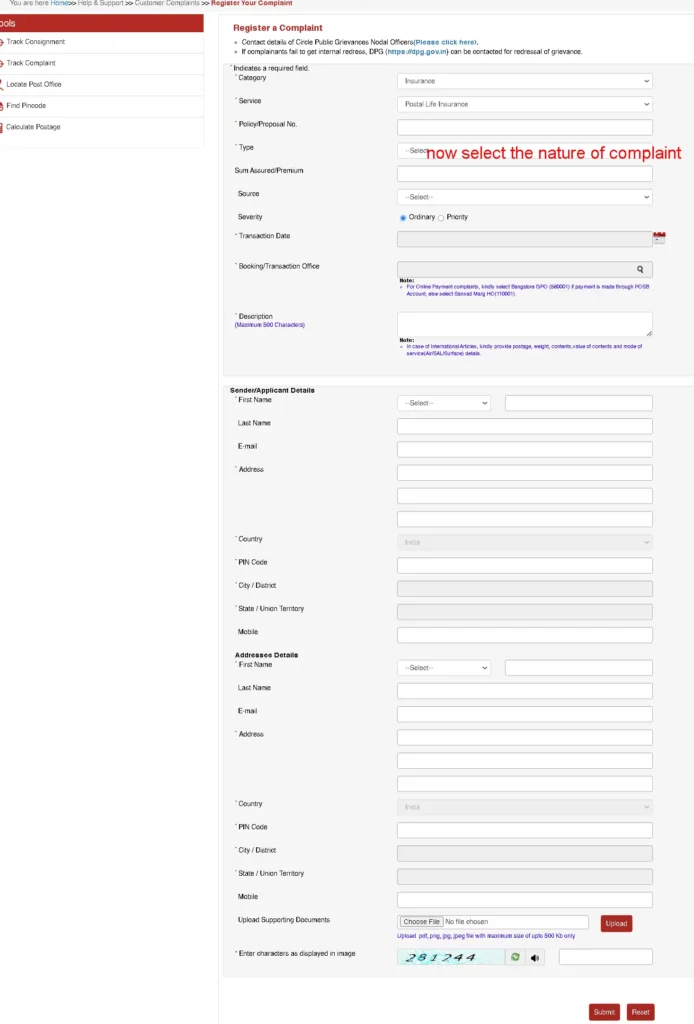

– Fill in the required details accurately.

- Category-Insurance

- Service -Postal Life Insurance

- Proposal/policy number-

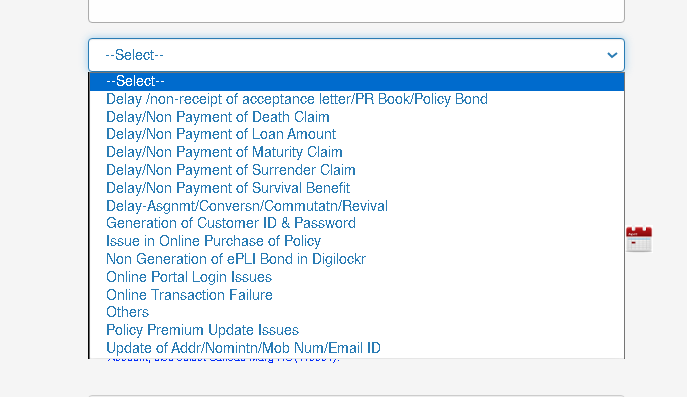

- Type- Nature of PLI complaint

Provide personal information such as name, address, and contact details.

– Specify the complaint details including policy number, nature of complaint, and any relevant information.

– Upload supporting documents if necessary.

– Verify all entered information for accuracy.

– Submit the complaint form.

– Receive a confirmation of complaint registration.

– Await further communication or resolution from the Postal Life Insurance department.

What are the time limits for PLI services to complete- PLI Citizen Charter

| Service | Standard (Time Limit) |

| Issuing of Policy Documents | Within 15 days of receipt of complete proposal |

| Delivery of Policy Documents | Within 7 days of dispatch from Head Office |

| Endorsement of Assignment/Nomination | Within 10 days of receipt of application |

| Revival of Lapsed Policy | Within 15 days of receipt of revival application & premium |

| Settlement of Maturity Claims | Within 30 days of receipt of claim form & documents |

| Settlement of Death Claims | Within 60 days of receipt of claim form & documents |

| Settlement of Surrender Claims | Within 15 days of receipt of surrender application & documents |

| Grant of Loan | Within 15 days of receipt of loan application & documents |

| Issue of Duplicate Policy Bond | Within 10 days of receipt of application & documents |

| Correction of Name/Address in Policy Documents | Within 15 days of receipt of application & documents |

| Processing of ECS Mandate | Within 7 days of receipt of mandate form |

| Providing Information (through Toll-Free No./Website) | Immediate response/within 24 hours |

Additional Points:

- All complaints will be acknowledged within 7 days of receipt.

- A final decision on all complaints will be taken within 30 days of receipt.

- If you are not satisfied with the resolution of your complaint, you can escalate it to the next higher authority or may also lodge complaint at DCAGRP