Invest in Post Office Scheme Online-2024

Post Office schemes have long been known for their reliability, safety, and attractive returns. In today’s digital revolution, the convenience of Invest in Post Office Scheme Online has made these schemes even more accessible to the citizens.

Here we will explore in detail the process of investing in Post Office schemes online, prerequisite highlighting its benefits, types, steps involved, and safety measures.

Introduction to Post Office Schemes

Post Office schemes offer a range of investment and savings options to the Indian citizen through Postal Service. These schemes are backed by the government, providing a sense of security to investors. Investing in Post Office schemes is considered prudent due to their low risk and steady returns.

Benefits of Invest in Post Office Scheme Online

Safety and Security

One of the primary advantages of Post Office schemes is the safety they offer. As these schemes are government-backed, your invested money is considered secure, providing peace of mind to investors irrespective to limit of investment compared to Banks.

Guaranteed Returns

Post Office schemes typically offer fixed returns, ensuring a steady income stream for investors. This makes the Post Office Scheme an attractive option for individuals searching stable investment options with peace of mind.

Tax Benefits

Many Post Office schemes offer tax benefits under Section 80C of the Income Tax Act, allowing investors to save on their tax liabilities like PPF, SSA, 5yr TD and SCCS. This makes Post Office Schemes an efficient tool for tax planning.

Accessibility and Convenience

With the facility of Invest in Post Office Scheme Online-2024, accessing Post Office schemes has become more convenient than ever before. Investors can now manage their investments from the comfort of their homes, eliminating the need for physical visits to post offices. This is a revolutionary step by India Post in investment online in their postal saving schemes

Types of Post Office Schemes

Investors can choose from a variety of Post Office schemes based on their financial goals and risk appetite. These schemes can be broadly categorized into three main types:

Savings Schemes- Long and short-term

Savings schemes such as the Post Office Savings Account, National Savings Certificate (NSC), and Public Provident Fund (PPF), Term deposit, Mahila Samman Pachat Patra offer attractive interest rates, and flexible withdrawal provisions.

Investment Schemes- For Regular Income

Investment schemes like the Post Office Monthly Income Scheme (MIS) and Senior Citizen Savings Scheme (SCSS) provide regular income on a monthly or quarterly basis to investors, making them ideal for retirees.

Insurance Schemes- Postal Life Insurance Low Premium-Higher Bonus

Insurance schemes such as Postal Life Insurance (PLI) and Rural Postal Life Insurance (RPLI) offer life cover along with attractive investment returns, providing comprehensive financial protection to policyholders.

How to Invest in Post Office Schemes Online

Eligibility Criteria

To Invest in Post Office Scheme Online, investors must meet certain eligibility criteria, such as being a resident of India and having valid identity proof, in addition to a basic savings bank post office account already opened with any branch of Indiapost. These are th pre-requisites for availing of DOP Internet Banking;–

- Valid Active Single or Joint “B” Savings account standing at CBS-enabled Branch Post Office, Sub Post Office or Head Post Office.

- Provide necessary KYC documents, if not already submitted

- Valid unique mobile number

- Email address

- PAN number

Registration Process- Activation of internet banking

The first step in investing online in Post Office Schemes to register on the official website of the Indian Postal Service. Investors need to provide their personal details and create a username and password for accessing their accounts. The detailed process for registration for DOP net banking and activation of DOP net banking may check here

Choosing the Right Scheme

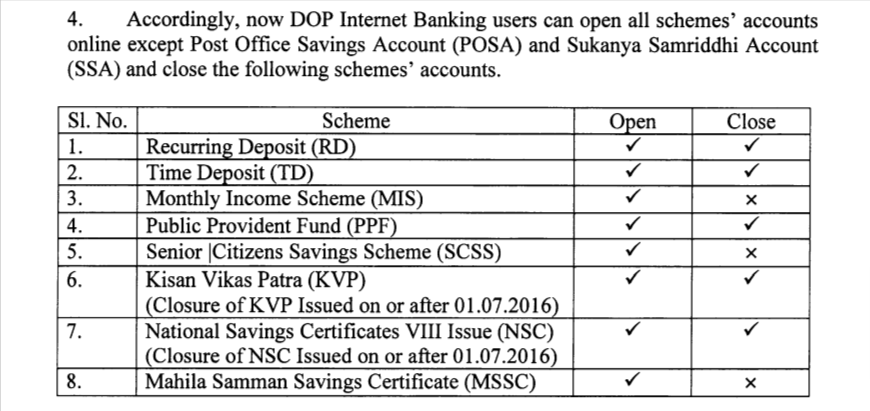

After registration, investors can browse through the various Post Office schemes available online and choose the one that best suits their investment objectives. At present in all postal schemes except Post Office Saving Account and SSA can be invested online.

Investment Amount- Fund Transfer from other bank to Post office account

Once you have successfully registered and logged in to your DOP net banking account, you can transfer funds from your other bank account or use the funds already available in your Post Office Saving bank account to invest online in other Post Office Saving Schemes easily. The process for fund transfer from your bank account to your post office account is already explained, may check here.

Steps to Invest in Post Office Scheme Online

- Create an Account and log in to net banking

- Visit the Department of Posts (DOP) Internet Banking website.

- Now click the ‘New User Activation’ button enter the ‘Customer ID’ and ‘Account ID’ and click the ‘Continue’ button.

- If a Dop net banking request is not submitted you can also visit your home post office branch, fill out the application form for activating Internet banking, and submit the required documents.

- Once your Internet banking is activated, enter your user ID and password to log in to your DOP Internet banking.

Selecting the Post Office Scheme

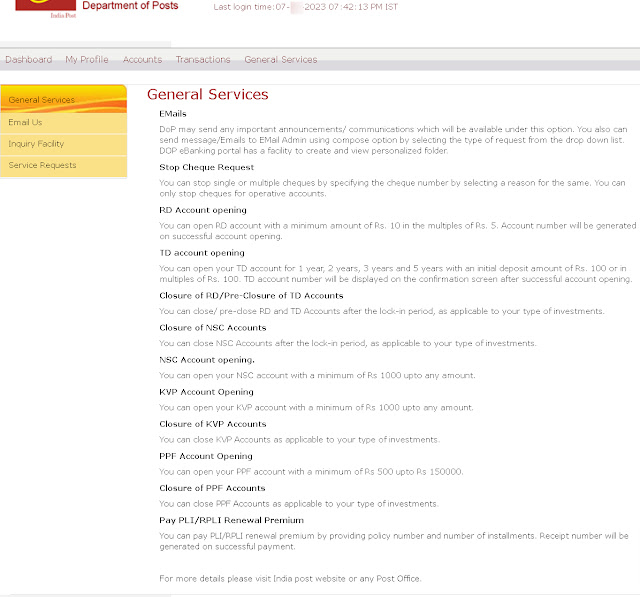

- After login -click on the ‘General Service’ tab on the menu and click on the ‘Service Request’ tab.

- Now under the ‘Service Request’ section, click the ‘New Requests’ tab.

- Explore the different Post Office schemes available online and select the one they wish to invest in.

- Select the type of account you want to open from the multiple options.

Payment Options

The next step involves making the investment payment, funds already available in your POSB Account will be utilized so ensure sufficient funds in your account or transfer funds from your other bank account through secure online payment gateways. Investors can choose from various payment modes such as net banking, and NEFT to transfer funds.

Confirmation and Receipt

Once the payment is processed successfully, investors will receive a confirmation email along with an e-receipt for their investment. They can also track their investments online through their accounts. Ensure log out and log in in again to check the investment details.

Safety Measures for Online Transactions

Secure Payment Gateways

Post Office websites use encrypted payment gateways to ensure the security of online transactions, protecting investors’ sensitive financial information from unauthorized access.

Keeping Credentials Safe

It is essential for investors to keep their login credentials confidential and avoid sharing them with anyone to prevent unauthorized access to their accounts.

Comparison with Traditional Methods

Convenience Factor

Online investing offers unparalleled convenience compared to traditional methods, allowing investors to manage their investments anytime, anywhere, and online closure of the investment. The maturity amount can be transferred from the Post office savings bank account to any other account of the investor.

Time-Saving

With online investing, investors can avoid the hassle of visiting physical post offices and waiting in long queues, saving valuable time and effort.

Accessibility to Information

Online platforms provide investors with easy access to comprehensive information about various Post Office schemes, helping them make informed investment decisions.

Tips for Successful Online Investments in Post Office Schemes.

Research and Analysis

Before investing online, it is crucial for investors to conduct thorough research and analysis of different schemes to understand their features, risks, and potential returns.

Setting Investment Goals

Investors should clearly define their investment goals and objectives before choosing a scheme, whether it’s wealth accumulation, retirement planning, tax saving, or regular monthly income like SCSS, or MIS. Recurring deposit is also a good option for small steps for big savings.

Diversification of Portfolio

Diversifying investments across multiple Post Office schemes can help spread risk and optimize returns, ensuring a well-balanced investment portfolio. Postal life insurance is also a good option for Govt. employees and RPLI for rural people.

Concerns and Misconceptions:- Invest in Post Office Scheme Online

Trustworthiness of Online Platforms

Many investors may have concerns about the trustworthiness of online platforms. However, Post Office websites adhere to stringent security protocols to safeguard investors’ interests.

Technical Support and Assistance

In case of any queries or issues, investors can reach out to the dedicated customer support team for assistance and guidance regarding online investments. The Investor may contact:-

Toll Free Enquiry Helpline: 18002666868

9:00 AM – 6:00 PM (Except Sundays & Gazetted Holidays)

IVRS facility is available 24*7*365

Conclusion

Investing in Post Office schemes online offers a host of benefits, including safety, convenience, and attractive returns. By following the above steps and tips, investors can make informed decisions and achieve their financial goals effectively.

FAQs

How safe is it to Invest in Post Office Scheme Online?

Investing in Post Office schemes online is highly safe and secure, as these platforms adhere to strict security protocols to protect investors’ funds and personal information.

Can I invest in multiple schemes simultaneously?

Yes, investors can diversify their investments by opting for multiple Post Office schemes simultaneously, thereby spreading risk and maximizing returns.

What are the tax implications of investing in Post Office Schemes?

Many Post Office schemes offer tax benefits under Section 80C of the Income Tax Act, allowing investors to save on their tax liabilities and optimize their overall tax planning strategies.

Is technical support available for online investors?

Yes, Post Office websites provide dedicated customer support services to assist investors with any queries or issues they may encounter while investing online.

How can I track my investments online?

Investors can track their investments online by logging into their accounts on the official website of the Indian Postal Service and accessing the relevant investment details and transaction history.

Can I invest in a post office scheme online?

Yes, except Post Office savings account and SSA, you can Invest in a Post Office Scheme Online.

Can I deposit money in the post office online?

Yes, You can deposit money in the Post Office online, may check here

Can I open a savings account and invest in different post office schemes online?

Yes, You can invest online in different Post office schemes except for POSB Account and Sukanya Samadhi Account.

May also like:-